Thursday Trivia : The Oracle Question of Portfolio Management

Thursday Trivia : Republic Day Special ~ Investors are you self-handicapping yourself ?

January 26, 2017Thursday Trivia : Bharat Bill Payment System

February 16, 2017

As Wealth Managers, we are often asked, ‘When equity market falls, our portfolio value also falls. But when equity market rises, our portfolio doesn’t seem to rise to as much.’

Image Courtesy :www.sharesinv.com

Enough theory is written about how equity markets behave. Thanks to the internet, all these theories can be googled in an instant. Most of the time, this leads to a lot of confusion. Not to mention, how television bombards us with news in trying to figure out what really happened. Participation of so called ‘experts’ on social networking fronts have also increased to a great extent. Too many people trying to hunt down a single event to see if they were correct in what really happened. Due to such bombardment, a retail investor is often left perplexed about what or whom to believe. It is often difficult for a retail investor to keep his belief in his equity market investments. This leads to a loss of confidence for a retail investor in the equity market as well as his own advisors. Which is often concluded that real estate or a fixed deposit with a bank as a safe heaven for their money.

Other important factor is about ‘Basic Education of the equity markets’. This doesn’t mean news, a special course on investing, behaviour aspects, etc. It simply means, knowing that nobody understands the behaviour of equity markets. It’s the fundamental truth. That’s why it’s not really important to predict what the price of a particular stock of a company. As often as we see, market predictors often make money through prediction and not really by investing their own money.

An equity market has to be viewed as a collection of businesses, where a right of ownership is available upon paying a certain price. An investor’s portfolio will consist of several such businesses. The more concentrated a portfolio looks, it shows higher capacity to take risk of the investor, while a diversified portfolio indicates a lesser capacity to take risk. A conventional wisdom that tells us, higher risk leads us to higher returns. But is that really true? That’s why an investor often gets carried away to take on unnecessary risks. Owning few businesses is a full time job, since it’s important to know what exactly is happening around. Immense study is required for the same and constant monitoring of the micro as well as macro forces of the equity markets.

On the face of it, it looks a tremendously smart to only invest in few companies as it gives massive bragging rights to an investor as well. During good times, an investor is often heard as, ‘while the entire markets were up by 2% today, but my portfolio was up by more than 5%’. To add salt to this, other investors also applaud such an achievement. While most others try and copy to achieve such an out performance. Some will go to an extent of selling their existing portfolio and model their portfolio according to those who outperformed yesterday. Such is the greed.

Basic mantra of equity markets is that they are cyclical. Good times are often followed by bad times and vice-versa. If that was not the case, then there was no need to have an equity market. Investors would simply put in their money, make profits and invest in other companies to gain more profit. There would be no case of ‘margin of safety’, ‘cheap stocks’, ‘cigar butt stocks’ and many more which are illustrated by greatest investors like Warren Buffet, Charlie Munger, and their likes. Warren Buffet has quoted, ‘only when tide goes out do you discover who’s been swimming naked?

Image Courtesy :www.news.forex.live.com

It is at such times that intelligence and expertise of investors is tested. While holding out fewer businesses, it is more likely that he will lose out more than entire equity markets combined. There may be several reasons for it. But the fear will be struck deep within the subconscious. Others, who followed the suit while portfolio was performing, will be seen doing the same. Everyone switching on their television to see and figure out what the real reason was and will end up listening to the so called experts once again.Though nobody would admit to the basic education of equity markets that nobody can predict them.Maybe because fear takes over. In fear, humans are always keen on reasoning it out rather than trying to take corrective actions. Only a handful take corrective measures and learn from them. Rest end up making the same mistake twice.

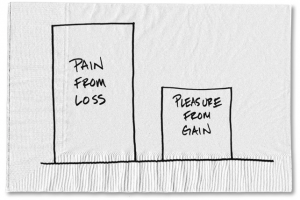

So many times, we read that it is important to sell when markets are high or expensive and buy when market are low or cheap. Do we pay any heed to it? Turns out that most of us don’t like the idea of losing. In fact, in the world of behavioural psychology, it is termed as ‘Loss Aversion Tendency’. We feel the pain of loss more acutely then we feel the pleasure of gain. In other words, we may like to win but we hate to lose.

To give a small example, we’ve all heard (probably a lot) about the downfall of Lance Armstrong. In the documentary “The Armstrong Lie”, he has opened up on talking about what drives him. This is what he has to say : “I like to win, but more than anything, I can’t stand the idea of losing. Because to me losing is death.”

Image Courtesy :www.behaviorgap.com

This leads to a very simple question, ‘when markets are cheap and an investor enters, does he double his money the very same day?’ and ‘when market falls, how many investors not only lose their profit but also lose a significant part of their capital?’ Such is the irrationality of the equity markets, when it falls, it takes away a lot but while it is cheap, it gives very few options. Oh wait, isn’t that a human tendency as well? Think about it.

If such equity markets are not driven by such irrational decision making of investors then who else drives them?

To sum it up, just think about a tree. During autumn, it sheds it leaves very quickly. However, during the spring time, it takes time to grow it’s leaves. Just the same way, rather than worrying about the above oracle question, try to nurture yourself and your portfolio which can withstand autumn and spring with equal happiness.