Thursday Trivia ~ Why Have Stock Prices Risen? – The Templeton Way!

Thursday Trivia ~ GILT Funds – Mutual Funds that invest in Government Securities

November 26, 2020Thursday Trivia ~ The fairytale story of low interest rates and this time it’s different!

December 24, 2020“History Doesn’t Repeat Itself, but It Often Rhymes” – Mark Twain.

Sir John Templeton is regarded as one of the pioneers of the investment management business. Every era has its own heroes, those who redefine the traditional ways. In 1950s belonged to Sir Templeton while the future belonged to Warren Buffet. To draw a corollary, like the late 90s belonged to Rahul Dravid but was overshadowed by the legendary Sachin Tendulkar. That’s why most of us would have heard about Warren but not many know Templeton.

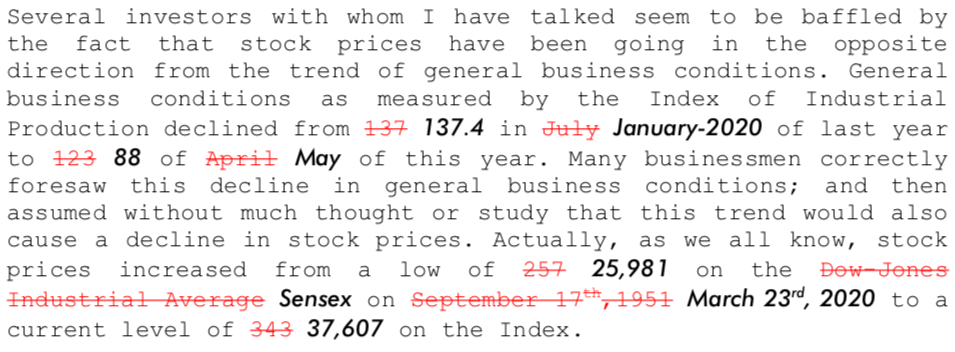

During the last week I was catching up on some reading, I stumbled upon Ambit AMC’s August 2020 newsletter (click here to read). Ambit cheekily reproduced the Sir Templeton’s (1952, recirculated in 1954) letter to his investors which sounds a lot like it was written just yesterday. Original can be read at – WHY HAVE STOCK PRICES RISEN?

The letter echoes striking similarity with today’s market scenario. Investors are baffled with how stock prices are going up when the on ground reality is completely opposite. Ambit’s newsletter only makes changes to numbers while the text almost remains the same. Have a look.

While the word on street has been that liquidity has been the major driver of this market and it’s unprecedented. The amount of money pumped into the markets by DIIs and FIIs alone have been close to US $3 billion. This has created ‘This Time It’s Different’ symptom. It’s very difficult to convince people that such events have occurred in the past. While I was looking at some quant related information on it, I encountered a silver lining. Let’s hear it from Sir Templeton himself of what he wrote to his investors.

He then goes on to say, “No one knows how much new cash is flowing into common stocks each year. However, we do know enough to realize that the total is very large.”

Isn’t it a very similar stuff that we are listening to these days. So this time, it’s not different.

So what should you as a retail investor do under such circumstances?

We are not in the business of selecting stocks for our clients. It’s a job we leave it to capable fund managers who run mutual funds, hedge funds and portfolio management services.

Our concern is to provide you with financial freedom where you don’t need to worry about money at all. A stage of life where you live your life without having to worry about paychecks or bills. To attain such a stage, we will echo the same old grand-motherly wisdom which is to spread your eggs in different baskets or not put your eggs in only basket.

Asset Allocation

There is way too much material written on it. So I will try to explain with a reference to competitive exams.

For example, a student has to prepare for 10 subjects to become a professional in the finance industry. Out of 1000 total marks (10 papers of 100 marks each), he needs 500 to pass on aggregate and 40 on individual subjects. So getting to 400 is the baseline goal. Nobody can compromise on it.

Now the next set of challenge comes – how to get additional 100. So a student then picks out his favorite 5 subjects where he will give a shot to get more than 60 marks. The rest 5 can meddle anywhere between 40-50.

If he gets 60 marks in 5 subjects and 40 in other 5, he will get 500 on the line and become a professional. A few marks extra in the range of another 10-20, then he would have cleared it with a margin of safety.

This preparation also includes a few tough subjects where scoring more than 50 is almost impossible because it’s the very nature of these subjects. Not in the hands of a student. Yet, a student tends to try his/her best.

Now let’s just correlate.

There are 4 prominent asset classes such as equities, debt, real estate and gold. The very nature of real estate and gold is illiquid and hence money once blocked, it becomes very difficult to plan for them. That’s why holding excessive real estate gets in the way of peaceful retirement.

Debt has its own limitations. With fixed deposit rates slowing down and other debt funds also giving lower returns, an investor puts his entire bet on equities. This is one of the reason we see investors rushing to create 100% returns in a year and end up losing almost half of their capital in such a pursuit.

So what should you do?

Remember, a student only needs 60 so that they are able to cover up for papers where he scored 40. Excessive greed to score 80 might not be the right idea. Because when question paper is tough, these calculations then go haywire.

That’s why we say, moderate your equity expectations to 10-12% odd. Create a financial plan that enables you to take less risks. Don’t get swayed away by news or short term events. It’s unwise to book losses in pursuit of higher profits. Just like MS Dhoni does. Don’t lose wickets in the middle overs and smash the ball around in the final overs. Compounding works in a similar way. Warren Buffet created 99% of his wealth after his 50th Birthday.

Conclusion

Investors are often myopic in their vision. Every few years, they feel it’s the best time to make money after the market has already run up. Sometimes because of real estate, sometimes its Modi wave and what not. It has happened in the past and will continue to happen in the future as well. So don’t think that this time it’s different.

Just stick to your asset allocation. Because we don’t have to be smarter than the rest, just be more disciplined then the rest – echoing the words of Warren Buffet.

written by Jinay Savla