Thursday Trivia ~ The fairytale story of low interest rates and this time it’s different!

Thursday Trivia ~ Why Have Stock Prices Risen? – The Templeton Way!

December 4, 2020Thursday Trivia ~ 2nd Boxing Day Test match told us what Investors have been telling us since decades!

January 8, 2021Financial analysts are often notorious in their future projections. Give them data and they can make it sing whatever song you wish to hear. We get to experience this drama almost every single day.

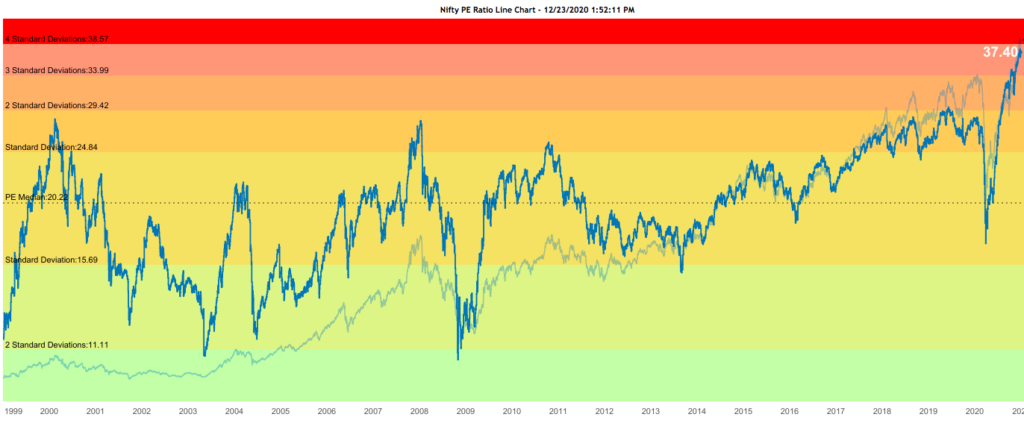

Consider the P/E ratio of Nifty50. As of December 23, 2020 it’s at a peak of 37.40 which is not just high but uncomfortably high. I started dabbling with stock markets in 2006, fresh out of school. At the peak of 2007, Nifty’s P/E was at 28.29 and madness followed. So does P/E matter or not, is a question to be pondered upon during bullish times because in bearish phase, P/E seems to be everything.

source: https://nifty-pe-ratio.com

2003-2007 were years of high growth and if you were a financial analyst that time, you would think about yourself as someone who could beat Goldman Sachs in their own game. Everything was going up. It was just about looking at infrastructure growth, putting some data in excel and you could have seen a phase that Nifty could even touch 1 lakh by 2020.

But reality is often different than fiction.

So what’s happening today that doesn’t make sense?

Low interest rates and the infusion of massive liquidity in the system. Most people in the financial services are echoing this. There is a general belief that since Reserve Bank of India (RBI) has kept its interest rates low which means you as a borrower get cheaper loans, this will somehow result in sudden pick-up in demand and stock market will continue to go up, up and only up.

Let’s do a reality check.

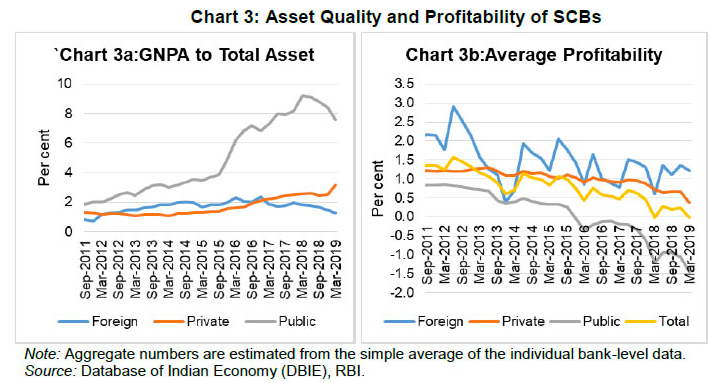

Financial systems in India are dominated by banks. RBI in its recent working paper – Asset Quality and Credit Channel of Monetary Policy Transmission in India: Some Evidence from Bank-level Data wrote about the impact of asset quality of scheduled commercial banks in India on the credit channel of monetary policy. The study finds that a robust credit channel of monetary transmission exists in India. Its efficacy, however, is impaired by poor asset quality but reinforced by better capital position of banks. Credit growth deceleration in India since 2013 is explained by asset quality stress in the banking system, slowdown in economic activity and moderation in bank deposits.

In layman terms, there is still more to this low interest rate story. India has good banking network. So when RBI says lower the borrowing rates, banks will oblige but will they be passed on to you immediately? The reason for that is bad loan stress or non-performing asset stress, slowdown in economic activity, lower deposits in bank and lower profits for the banks.

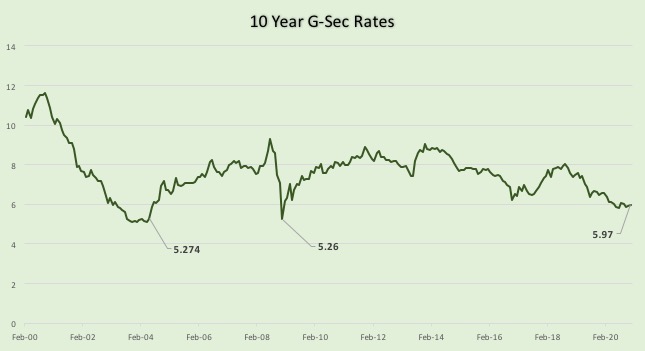

Another way to look at this is lowering of interest rates has also seen a sharp drop in yield of 10-year government securities (G-Sec). We have written about India’s G-Sec market that can be read here along with GILT funds extensively in the last month here.

An important point to consider is that the G-Sec yield too is nearing a 20-year low. This has happened twice before as can be seen in the chart below.

2005’s low was at 5.274, 2009’s low was 5.26 and as of December 2020, the yields are at 5.97

We are not in the business of prediction. Neither can we confirm which way the yields will go. It’s important to know that we are swimming in waters that have been only tested twice before in the last 20 years. History doesn’t repeat itself, but it often rhymes.

But a reputed fund manager of an asset management company recently highlighted the fact that 1% drop in interest rates will have a 25% appreciation in the valuations of equity markets. Reverse of which is true, 1% rise in interest rates will see a 25% depreciation in valuations of equity markets.

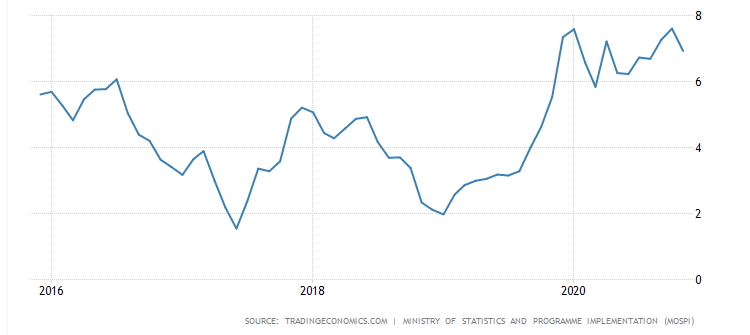

However, it’s not as straightforward for RBI to reduce rates all the time. Inflation (or price rise) can play a spoil sport to this party. Higher inflation would mean more money being spent on same essential items for us. It’s bad.

As you can see from the chart, consumer price index of inflation is now near a 5 year high. In such times, RBI tends to raise interest rates to slow-down the liquidity in the system. This will mean that the party of low interest rates will be over even before it’s started.

Currently, inflation is around 7.5% and RBI’s repo rate is at 4%. There is a gap of 2.5% which is beyond the comfort zone (0.5% to 1%) of any central bank. Yet, RBI has maintained an accommodative stance looking at the Covid-19 scenario.

Will inflation be brought under control or will RBI raise interest rates? Time will only tell.

There has also been speculation about commodity markets doing very well. Everything sounds hunky dory when experts talk about industrial numbers, most of which is beyond the understanding of common folks like us. Hence, we just look at this year’s performance of nifty’s commodity index. During lockdown, there was a stop in the industrial activity and we saw a sharp drop. Recovery has been fantastic.

It’s looking good as things are getting back to normal. From 1 lakh positive cases of Covid-19 per day to sub 30 thousand cases per day has been a show of strength from India. There are many theories to it which we don’t wish to delve into.

The only question that crosses our mind at this point is should we pay such a high premium for equity markets right now? Nifty’s P/E being at 37.40 makes us question.

However, if your asset allocation in line with your financial goals tell you to keep a certain amount in equities – then it makes more sense to stick with your asset allocation rather than wanting to time the market.

At Circle Wealth Advisors, we tend to follow the Dynamic Asset Allocation P/E strategy where we actively switch between equity and debt based on Nifty’s P/E ratio. Hence, the high P/E ratio coupled with new school of thoughts saying this time it’s different in stock markets make us wonder, are things really different?

written by Jinay Savla