Thursday Trivia ~ How you consume Time has a HUGE impact on Investment Returns!

Thursday Trivia ~ The glory of MS Dhoni and why it’s difficult to spot such stories very early!

September 11, 2020Thursday Trivia ~ Your Wealth Manager is extremely underpriced – The Apple Connection!

September 17, 2020What if I told you, my phone doesn’t have Moneycontrol App! Yes, I’m in the Wealth Management business and I don’t track prices of stocks. You’d think I’m joking, right?

Well, it’s true.

So, your next question would be – what do I really do between 9:15 am and 3:30 pm?

Well, the answer is pretty simple. It’s either speaking with clients or research or reading or writing. There are far too many activities to do than simply focusing on market tickers.

Now let me discuss the impact on my family’s portfolio.

It’s more than doubled in last 4-5 years. That too considering a major event in my life – marriage for which I had to withdraw a bit of firepower. Other than this, markets have gone through its fair share of ups and downs. Events such as Chinese currency depreciation, small and midcap boom and bust, nifty touching new highs and coronavirus washing away all the gains. It’s been a heck of a ride.

Two things worked for me. One was joining Circle Wealth Advisors and learning from my senior colleagues about Asset Allocation for peaceful investing journey. And secondly, my sheer unwillingness to look at prices of equity shares daily.

There is an extremely simple formula to make money in stock markets.

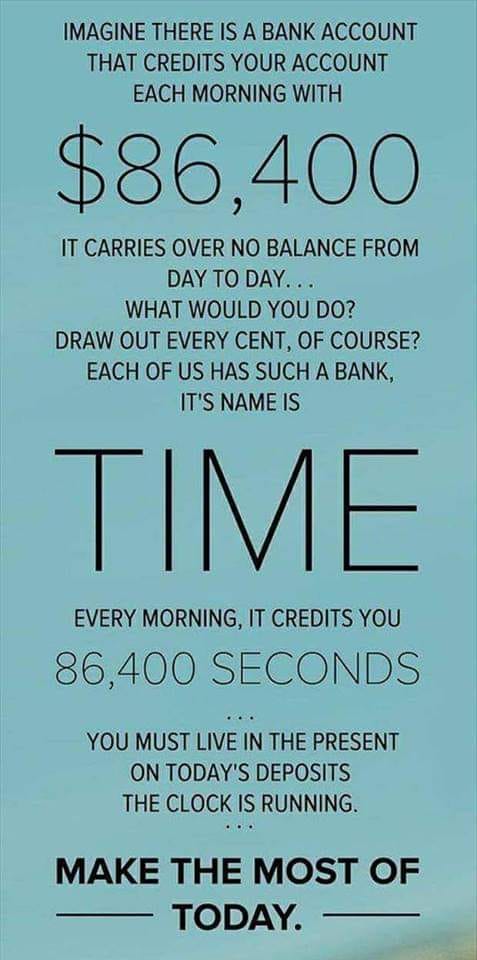

Returns = Money multiplied by Time

There are just two variables. Money and Time. That’s why the earlier you start, the better. More than enough has been written on it so repeating it again will be drifting away from the original topic that I wish to discuss here.

The Problem: Not enough Money, Not enough Time!

This is a common scenario we come across while conducting Investment Awareness Program. Either some people are in hurry to make a quick buck or some people just left it too late to realize they seriously need some sort of monthly cash flow in the event of retirement. It’s a common scenario. Some folks who are in completely unrelated fields to finance have some investment apps on their phone and ask us about stock tips.

I was shocked to see Doctors tracking equity prices and wondering what happened to a particular stock and why was it down 1% that day. While my senior colleagues in the industry being gone through the learning curve tell me it’s perfectly normal to see such things, I for one need some time to process it.

In today’s Thursday Trivia, I want to make ‘Money’ part completely irrelevant to become wealthy. It’s a practice that I’ve incorporated that I’m trying to share here.

So now, we focus on Time!

Every life coach stands by this rule – We have more time than we even imagine. The problem is not in lack of time, but in its consumption. Let me explain this with two scenarios.

Scenario 1: Preparation for Exams

During our college days, I used to burn the midnight oil to crack exams. It was fun. My friends and I would study through the night and go for early morning delicious Idli’s at Ramashraya, Matunga around 6 am in the morning. Then we will come home, sleep for a few hours and study again. The rush to finish the portion, studying long hours and the dream to crack exams was the thing that kept us going.

But we were terribly wrong. It was merely fashionable to study through the nights.

While my friends who were rankers in these competitive exams would be sleeping peacefully, we would be hustling around. Telling ourselves the crazy lies that rankers were just geniuses while we were the underlings.

Rankers prepared differently. If our exams were 6 months away, they would be studying for long hours at the library while we would be wandering around Mumbai streets on our two wheelers. And when the rankers would start revising their portion for the first time, we would open our textbooks. By the time, exams came we might just have done our first revision while rankers were done with their 5th revision.

Needless to say, they were relaxing on the day of results while we were praying for passing marks.

Sounds familiar?

Now, Scenario 2: Preparation for Investment Returns

Just like rankers, people who make incredible investment returns – start early! World’s biggest investor – Warren Buffet started at the age 11. India’s stock market barons – Rakesh Jhunjhunwala and Ramdeo Agarwal started during their teens.

Why retail investors can’t replicate this?

The very first answer that I receive during my Investor Awareness Programs is that these legends are geniuses. Some say, they have inside information while some feel they can move the market in a particular way they want to.

Do you see the problem here?

It’s the same for rankers’ v/s students like us who barely managed to scrape through. We felt they are geniuses too. And they can retain every bit of information in their head. But we fail to acknowledge a simple solution – they start early!

Starting early has a lot of advantages. One of which is you can course correct when things don’t go your way. It’s easier to lose 50% of your portfolio when you’re just 20 because there is life ahead. Money can be made again. It’s super tough to lose 25% of your portfolio when you are 55 years old, because there are responsibilities to deal with. And yes, course correction is a humongous task at that age. Very few are able to do it.

Now let me come to the second part of the article. This is the one I started with. I wrote that I don’t watch price tickers, and neither do I have Moneycontrol App on my phone. It’s crazy, isn’t it. Well, a well-known Fund Manager Mr. Saurabh Mukherjea of Marcellus Investment Managers too shares my enthusiasm of keeping a clutter free mobile phone.

Read about it at – Book Review – The Victory Project: 6 steps to peak potential!

What does a price ticker really tell you?

Price tickers on any given day speak about the interest in the equity stock. On Monday, there can be more buyers than sellers pushing the price upwards and on Tuesday there can be more sellers than buyers, pushing the price down. Then comes some sort of news that there was a small fire in the plant. This fire will not have any long term impact but the intra-day price is down. Does this mean, the stock will never perform?

Think about it this way. You have a business. There is a long term plan to capture market share from competitors and have pricing power. Such a pricing power will increase your margins. Resulting in massive profits. It’s a dream all of us have. Reality is always different.

So one fine day, while you are 5 years into the business, there is a small fire in your factory. Nobody is hurt. It was just technical issue. Money will be reimbursed by insurance company. In 1 week, it will be business as usual. Your clients have understood this anomaly because it’s a business problem. So they extend you more time to deliver. Because you have solid relationships with everyone around.

So my question is this – will you sell your equity of the business to someone just because of this incident?

Think hard about it. Because that’s what most retail investors do. Some good news and they will pump in money and one bad news, they will sell every single equity share. And they lose out on creating massive wealth for themselves.

That’s why the path to create wealth in equity markets is simple but not easy. We all consume Nestlé’s products every day and yet we won’t hold that stock in our portfolio. Many people sold it during the Maggi fiasco. But this happened!

image source: screener.in/Nestle

If you were close to the ticker and saw a bit of a fall in the stock price, then chances are Nestlé is not part of your portfolio now. For those who were never looked at the price or news, they practically doubled their wealth in this stock.

Yes, there are bad companies too. And a retail investor should be vigilant too. There’s a way out.

If you’re a retail investor, then it always works to hire an investment expert. The one who understands that daily movement of stock prices have no impact. The one who helps you to see the bigger picture. In my case, it was Mr. Saurabh Mittal, Founder of Circle Wealth Advisors who helped me to wake up from day to day prices to the wonderful world of compounding.

That’s the reason my day is completely stress free. Markets can go where they want to. With right asset allocation in place, I focus on delivering the same stress free life to my clients.

In a nutshell, start early and don’t watch markets. Stop wasting your time watching price tickers, it doesn’t add an iota of productivity. Focus on the job at hand, if you’re a doctor then treat your patients, an engineer than work your code, a teacher than build a better nation. Just don’t fall in the trap of making quick money, ever!