Thursday Trivia ~ Ghost Transaction from your Bank Account, RBI says ‘Relax’!

Thursday Trivia ~ Diwali Special – Did you know about latest development in EPF?

October 19, 2017Thursday Trivia ~ What is Recapitalisation and How it impacts you!

November 2, 2017

‘Rs. 15,000 worth of shopping! Who did this without even asking me? This credit card is kept at home to serve your need, not greed!’ somehow Mahesh was super pissed checking his account. As a habit, he would check his bank account daily. So many times, Naina had poked him for this habit. This habit of Mahesh had come into play after demonetisation as they now completely shifted to cashless system for their expenses. Naina was a little stunned because she had not spent this money and no one else had access to that credit card of Mahesh. Naina started to check her phone for any SMS and there she found a transaction message for the same.

Mahesh was shocked. How come such a thing had taken place. For a moment he felt like getting hold of that fraudster and pouring all his anger over him. Naina had a better control on her emotions. She immediately started to think, ‘what can be done to salvage this situation as of now?’ As a result, both of them turned to Google for answer.

Naina found a circular of Reserve Bank of India titled : Customer Protection – Limiting Liability of Customers in Unauthorised Electronic Banking Transactions (RBI/2017-18/15DBR.No.Leg.BC.78/09.07.005/2017-18)

While reading, Mahesh looked at Naina and asked, ‘have you shared the account details, net baking or credit card details to your mother for shopping?’ With an angry face, Naina replied ‘No, have you given it to your mother?’ Mahesh understood this backfired and politely apologised for the same. ‘I just asked so that we know from where did that transaction take place’ Mahesh said trying to salvage the situation. ‘Oh really, don’t cover up’ said Naina with a raised eyebrow.

Mahesh calmly replied, ‘It’s not like that. As per the guidelines, if either of our mothers would have shared our payment credentials with anyone then we would have to bear the the cost of entire transaction until we report it to the bank. However, any transaction which happened after we reported would be bank’s responsibility. Yet, we would be in loss at the end of the day. Isn’t it so?’

‘Yes, you are right. Sorry, I just got a little angry over it.’ Naina replied in an apologetic manner.

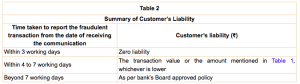

Mahesh was reading the guideline where it was mentioned that if the responsibility of the unauthorised transaction lies with someone else in the system and not customer or bank then he will be getting full refund if only it is reported under 3 working days. This gave a little relief to Naina as well. They could report this tomorrow morning to the bank. Within 10 working days bank would refund the same to them.

Naina, the intellectually curious one of the two, said ‘let’s read it completely so that we can help someone out as and when such a thing happens with them.’ Mahesh silently agreed (he couldn’t take a chance after that recent disaster).

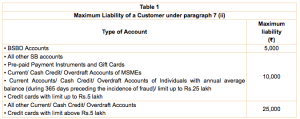

Incase, the unauthorised translation has been notified to the bank after 3 working days then maximum liability (Table 1) of the bank would be restricted. Such restriction would be applied when customer notifies the bank within 4-7 working days (Table 2). If it is notified beyond 7 working days then maximum money that customer would get back is as per Bank’s approved policy, regardless of the amount of unauthorised transaction. In digital age, with SMS notification this doesn’t seem to harsh on the customer. Does it?

‘The best part of the whole guideline is the burden of proving customer liability in case of unauthorised electronic banking transactions shall lie on the bank and not the customer’ Mahesh said in excitement.

Naina looked at him and said, ‘my resolution for life is to check every SMS message that comes on my phone, atleast that might ensure you don’t sit with reconciling bank accounts each day.’

Finally, feeling relaxed Mahesh closed his laptop. But there was another problem staring at him. In this rush, he didn’t realise dinner had become cold. He tried to look at Naina and to his surprise, she smiled and said ‘I will heat the dinner and you put on some movie, it’s been such a long time we haven’t seen one.’ Both smiled and heaved a sigh of relief.

Photo Courtesy : Reserve Bank of India

– Jinay Savla