Thursday Trivia ~ Asset Allocation (Series 1 of 3)

Thursday Trivia ~ FD to MF (Wait and Read this first)

May 25, 2017Thursday Trivia ~ Asset Allocation (Series 2 of 3)

June 22, 2017One day, Amar was sitting with his wife to decide about their investments. Normally, Amar’s uncle who works for a company which regularly deals with stock markets, advises him. Inadvertently, Amar always invests in the shares of the companies suggested by his uncle. Which has resulted in a list of 55 stocks, report of which is about 3 pages. Amar got too confused as he cannot keep a track of all these companies. His wife suggested it’s time they took an advice from a professional wealth manager. However, Amar was reluctant at the start as he didn’t need a third person to advise him on what he should be doing with his hard earned money. At the end, the couple connected with a wealth manager.

With professional advice, Amar was suddenly exposed to concepts such as goal planning and asset allocation. A term which was heard yet understood at the very least. An additional layer of reluctance was built up. Yet, he got enlightened to the fact that how unplanned his money management is and to build on that, he had only considered shares bought by him as investments.

It happens with most people when a question is asked ‘where are your investments?’, a standard reply is always shares and mutual funds. When a second question is asked, ‘are you tracking your investments?’, reply emerges as ‘yes, we get quarterly reports and we know what’s happening.’ Nobody is wrong here. Labour pays the highest returns, hence the focus is always on the task at hand. Yet, it becomes tremendously important to have that hard earned money, make money in return. Which is precisely where asset allocation comes into the picture. It’s a subject that every wealth manager discusses with his investors. Not just to educate them, but to make them better investors.

Asset allocation is defined as an investment strategy by which an investor or a wealth manager attempts to balance risk versus reward by adjusting the percentage of the amount invested in an asset of a portfolio according to the risk tolerance of the investor, his/her goals and the investment time frame. Too complex, isn’t it? Let’s break it down in simple words.

Asset classes are usually the very first word used by a wealth manager. Broadly, there are 4 types of asset classes:

- Real Estate

- Fixed Income Instruments such as fixed / time / recurring deposits / liquid funds, loan given.

- Equities such as shares of companies / mutual funds / PMS, etc.

- Commodities such as Gold / Silver, etc.

Asset classes serve different purposes for an investor. Hence, an appropriate allocation should be created by investing a certain percentage of wealth in each of the asset classes. However, it should be taken into consideration that real estate, insurance and fixed income instruments with a maturity date are illiquid. Rebalancing of real estate and insurance cannot be done on a particular date every year. Even fixed deposits with a higher maturity period cannot be rebalanced. Such challenges must be carefully looked into while creating a portfolio.

Risk mitigation is also an important characteristic of asset allocation. As the investor’s portfolio is diversified in different instruments, risks arising from news-based events will not have major impacts. For example, if the Reserve Bank of India decides to cut interest rates, then the interest yield on fixed deposits will go down. Conversely, as this move makes loans cheaper for companies their profit margins will rise. Better earnings will attract higher price which will create a positive impact on equities. Hence, such an exercise takes away the pressure of any unforeseen event. With this, let’s look into different strategies for asset allocation.

There are 3 key strategies to asset allocation, such as:

- Strategic Asset Allocation

- Tactical Asset Allocation

- Dynamic Asset Allocation

Strategic Asset Allocation

A portfolio strategy that involves setting target allocations for various asset classes, and periodically rebalancing the portfolio back to the original allocations when they deviate significantly from the initial settings due to differing returns from various assets. Too technical? Let’s break it down to simple words.

For example, Virat Kohli and MS Dhoni are chasing down a target against Pakistan. In last 10 overs, they have to make 100 runs. With these 2 at the crease, every Indian is sipping a nice tea at home without any worry. In simple terms, they need to make 10 runs every over. So, the strategy would be at least hit a boundary in every over. If they stick to this strategy, then if in the first 3 balls MS Dhoni hits 1 six out of the cricket ground, resulting in just 4 runs to be taken during the over. It will help them in not hitting every ball for a boundary (controlling greed) and not be losing a wicket by playing any risky shot (controlling fear). If they just make 10 runs every over, India will win the game with relative ease and less stress. Not to forget, even the tea will taste damn good.

Similarly, when an investor parks his money in different assets. Their values change over time. But if the goal is to reach a specific net worth after which the investor won’t need to work for money. Then a rebalance in his portfolio can be made based on the investment period which a wealth manager and investor mutually decide. Usually, it’s semi-annually or annually. Rebalance helps in bringing back the investments to the same allocation which had been pre-decided and entered into.

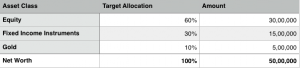

When Amar sat with his wealth manager, he was delighted to have a new world open up to him. Conversations were around his most important goal – retirement, for which strategic asset allocation had to be implemented. Retirement was due after 15 years. As maths worked its way, Amar would need a corpus of Rs. 2 crores upon his retirement to maintain his current lifestyle adjusting for inflation. With his current corpus of Rs. 50 lakhs, exposure of 60% equity, 30% fixed income instruments and 10% in Gold was decided. With 10% returns on his portfolio for the next 15 years, a corpus of Rs. 2 crores looked achievable. It was mutually decided to rebalance the portfolio annually. The stress of life after retirement was suddenly taken off from Amar and his wife’s mind.

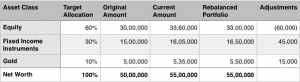

After a year, Amar met with his wealth manager. Investments in equity had gone up by 12% becoming Rs. 33.60 lakhs while his fixed income instruments and gold went up by 7%, resultant Rs. 16.05 lakhs and Rs. 5.35 lakhs respectively. As Strategic Asset Allocation demands investment to be brought back to original allocation (annual rebalancing), Rs. 60,000 worth of equities had to be sold and Rs. 45,000 worth of fixed income instruments and Rs. 15,000 worth of gold needed to be bought.

So now, Amar’s investments had grown from 50 lakhs to 55 lakhs. This way, his allocation remains the same as it was entered into a year ago. There is no need to rely on anyone to decide what to buy and what to sell. By just sticking to the strategy, decisions can be taken with a relative ease.

In our next Thursday Trivia, we will cover Tactical and Dynamic Asset Allocation. Till then, in case you have any query please do write in the comment section below.

Disclaimer: This particular series of Asset Allocation is only meant for educational purposes. We do not in any ways recommend it, as the case may differ for investors per se. These are simply model strategies of asset allocation, hence modification is required for each investor.

– Jinay Savla

1 Comment

Worth reading it this article very nicely explained in detail with examples. Got and idea how to make a strategy for future investment