Thursday Trivia~Simplicity is the ultimate sophistication – do you agree?

December 8, 2022Thursday Trivia~The Importance of Patience in Investing: Lessons from the Chinese Bamboo Tree

December 29, 2022

The Mount Erebus disaster is considered one of the deadliest crashes in the history of Air New Zealand. On the morning of 28th November 1979, a sightseeing flight left Auckland airport. It was supposed to fly over Antarctica for some time and come back in the evening. But the flight crashed into Mount Erebus, killing all 237 passengers and 20 crew members. There was a huge outcry, and authorities did a detailed investigation to learn the cause of the accident, which one can read on Wikipedia. The root cause is believed that the crew was not informed about a correction of navigation by two degrees in the flight path the night before. So instead of navigating through the McMurdo Sound, the plane flew into Mount Erebus.

I did not initially believe that changing two degrees could lead to a huge mistake. In fact, they have a thumb rule called the rule of 1 in 60, which navigators use extensively for navigation and course correction. The rule states that if you deviate by 1 degree from your path, you will be off by one whole mile after travelling 60 miles. There are YouTube videos explaining the maths behind it.

We often use this analogy, how financial planning is similar to travel planning. You plan to start from point A ( your current financial situation) and reach point B (financial goals, including financial freedom). Planning is not a certainty of your experience and reaching your destination, but it gives fair visibility of what it would take to complete the journey.

Since everything we plan will happen in the future, we need to draw assumptions similar to a flight path to reach our destination. There are various assumptions regarding the returns a particular asset will generate, the long-term inflation rate, growth in income levels and so on. These assumptions, if not kept in check or are unrealistic, may lead to disasters like in airlines.

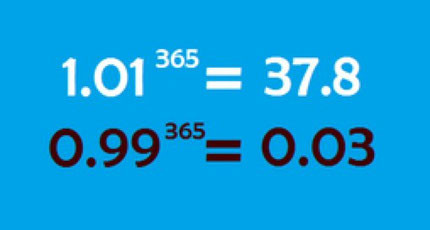

We have read so much about the power of compounding; the most common example cited in the market is that of WIPRO. If one had invested Rs ten thousand in WIPRO at the end of 1980, it would have grown to Rs 991 crores in 42 years @38.92% pa. But for assumption, if I round off this growth rate to 39% pa, the current amount will be Rs 1015 crores. So a minor assumption error can result in a considerable deviation from the destination. Have a look at this interesting equation.

A slight change of 0.02 over a reasonably long period can compound into a huge difference.

Let’s look at an example of a 25-year-old person starting her career with yearly expenses of Rs 10 lacs. She will have annual expenses of 3.3 crores at the age of 85, with assumed inflation of 6%. But if the inflation is assumed to be 6.2%, the expenses will rise to 3.7 crores – an additional 40 Lakhs per annum.

So how do we mitigate this risk of assumptions? Here are some pointers.

·

- Arrive at your personalised assumptions based on your lifestyle and career growth.

- Be a bit conservative or critical while planning (increases your margin of safety)

- The dynamic world demands revisiting these assumptions and checking for an upgrade.

- Keep recording these changes.

Please write back with your feedback and suggestions.