Thursday Trivia ~ But this time, they’re different!

May 4, 2017Thursday Trivia ~ Here’s everything you want to know about RERA

May 18, 2017I can’t change the direction of the wind, but I can adjust my sails to always reach my destination. ~ Jimmy Dean

Tax planning since ages has been left to year end. It’s not an easy feeling to share part of earnings with government. Tax slabs start to get bigger and exemptions from tax start to feel smaller with an increase in salary income. Salaried class have always felt a certain sense of disadvantage to the system. Is it really a disadvantage or just lack of planning? Both sides of the coin can be intensely argued upon depending on the side one chooses to be.

There definitely is a psychological disadvantage to the salaried class, since they have always felt business class gets major tax benefits.

- Ability to declare whatever income they want to (it’s the most important one),

- Charge extra business expenses,

- Use cash and not cheque (situation has changed since demagnetisation),

- Family vacations can be shown as business tours and charged as business expense,

- Depreciation on a car (when taken for business), and many more.

On the contrary, business class feels that salaried class is always at a certain advantage then them. Such as,

- Predictable cash flow,

- Planned vacations with friends and family,

- Tax already deducted at source from salary, so no need to worry at the year end,

- No stress of business market fluctuations, and many more.

In their own ways, both these classes are correct at their standpoint. In this trivia, we are addressing tax planning for salaried individuals. Since the very habit of leaving tax planning and investment planning to the very end has entered everyone’s bones, it makes far more sense to change this habit and start to plan from the very start. As the famous saying goes, precaution is always better than cure.

The salary structure may differ in various organisations. Various allowances and perquisites are offered depending on the sector and location of the organisation. Therefore, at the start of the year, take these following steps to ensure proper tax and investment planning.

Step 1 : Compute your in-hand income for the year

Usually, incase of salaried employees, tax computation is done by the company itself. Accordingly, tax is deducted at source (TDS) while crediting the salary into employee’s account. However, there maybe occasions where employee has different source of income other than salary. For example, if a person has rent income from a residential or commercial property, or interest received on fixed deposits, etc. In such cases, employees can either disclose this information to the company and accordingly the company deducted TDS from salary and credits the tax with government. Or employee independently takes care of tax on other part of his income.

In both cases, tax must be computed on the total income, not just salary income. This step will ensure cash flow for the year.

Step 2 : Eligibility for Tax Deduction

Tax deduction helps in reducing taxable income (computed from above). Inadvertently, it decreases overall tax liability and helps save tax. Depending on the nature of tax deduction, it’s amount varies. It can either be claimed from the amount spent in tuition fees, medical expenses and charitable contributions. Or it can also be claimed by investing in various schemes such as life insurance plans, retirement savings scheme and national savings schemes, etc. to get tax deductions.

The most useful tax deductions which can be easily claimed are :

- For investment specified under Section 80C

A total tax deduction of Rs. 1.5 lakh per year can be obtained under this section. The amount being a combination of deductions available under section 80C, 80CCC and 80CCD (mentioned in point 2 below)

Some examples of the specified investments are :

- Personal Provident Fund Account

- Tax Saving Mutual Fund

- Tax Saving Fixed Deposit

- National Savings Certificate

- Repayment of Principal on Housing Loan

- Premium on Life Insurance Policy

- Equity oriented Mutual Funds

- Contribution to Employee Provident Fund

- For contribution to Pension Funds under Section 80CCC and 80CCD

80CCC – Deduction for contribution to Pension Funds (PF)

80CCD – Deduction for contribution to National Pension Scheme (NPS)

Financial year 2-15-16 onwards, an additional deduction of Rs. 50,000/- is allowed for investment in NPS Account. This additional deduction of Rs. 50,000 is over and above the deduction allowed to be claimed under Section 80C and Section 80CCC.

To sum it up, the cumulative total of these should not exceed Rs. 2,00,000.

- For Interest on Savings account under Section 80TTA

This section permits deductions to the tune of Rs 10,000 every year on the interest earned on money invested in bank savings accounts in the country. Such Interest Income is first added under head “Income from Other Sources” and then deduction from such income is allowed.

- For interest on home loan under section 24

If there is a statutory commitment of a home loan, the amount of tax deduction allowed is on the interest component of the loan. It should be noted that this deduction under Section 24 is for the Interest levied and not for the interest paid.

Please note that : the principal amount of Home Loan repaid is allowed as a deduction under Section 80C and the Interest levied is allowed as a deduction under Section 24.

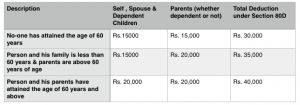

- For payment of medical insurance premium and health check up under section 80D

Any payment made for medical insurance premium for self, spouse and dependent children, a deduction of Rs. 15,000 can be claimed under section 80D. In case, the payment is made by a senior citizen or anyone with dependent parents who are senior citizens, additional Rs. 20,000 can be claimed as deduction under this section.

To sum it up, following are three scenarios :

- For interest on education loan under section 80E

This deduction is only for the repayment of interest on education loan and not for the repayment of the principal amount of the education loan. The good part about this income tax deduction is that there is no maximum limit on the amount of deduction that can be claimed.

This Deduction is not only allowed for Education in India but also allowed for Education outside India as well.

- For rent under section 80 GG

If house rent is paid and a deduction from the same is not claimed under any other section, then it can be claimed under section 80GG. Incase, if an employee doesn’t receive house rent allowance (HRA) benefits under section 10(13A), then he/she is allowed for a deduction under this section.

Te Deduction allowed under Section 80GG for payment of rent shall be the least of the following:-

- Rs. 5,000 per month

- Rent paid (minus) 10% of the total income

- 25% of the total income for the year.

Step 3 : Is there space still left for exhausting the tax deduction limit under section 80C

Often times, tax saving investments are done at the end of the year. Only to fulfil some pre-conditioned prophecy. It is common for salaried employees, at such times to go on tax saving hunt. Hence, there is not much thought inclined towards where that money should go. Most of the times, investments are done either in personal provident fund or some hot mutual fund amongst peer pressure. As a few years go by, there is an angst towards that investment incase it has not performed according to expectations or something else performed better.

Hence, it is advisable to fill any gap upto Rs. 1.5 lakhs at the beginning of the year. With a calmer mind, it becomes easy to identify different space of investments.

Step 4 : Investment Planning

After doing the above calculations, the next step is an obvious one ie. Investment Planning. Just deduct all the expected expenses for the year and the amount which remains can be comfortably allocated towards making long term investments.

When each day, we work for money, in the long run it’s also important to have money work for us. Hence, planning for investments become a very important activity. Investing into mutual funds, shares of a company, corporate or government bonds, etc. ensures long term growth of money. However, treating these as mere short term game plan to make quick money can also backfire. To enjoy the long term benefits, it’s important to marry your investments and only utilise them when no other source is available. It will ensure, safety and long term wealth creation.

It’s a good idea to retire rich, isn’t it?

– Jinay Savla