Thursday Trivia ~ Understanding the basics of India’s Government Securities Market

November 19, 2020Thursday Trivia ~ Why Have Stock Prices Risen? – The Templeton Way!

December 4, 2020In our last Thursday Trivia ~ Understanding the basics of India’s Government Securities Market we spoke about investors can look at investing in government securities in India. This week, we take one step further and talk about Mutual Funds that invest in these government securities (g-secs).

These are primarily debt mutual funds. The nickname gilt comes from gilded edge certificates which is nothing but certificates issued for government bonds. In short, you have a mutual fund manager who uses his or her experience to pick up short term or long term government bonds or gilts, creates a basket which is his mutual fund portfolio and offers it to his investors. In equity mutual fund, they pick up shares of different companies. In a similar way, in gilt they pick up different g-secs. A retail investor has to pay its Net Asset Value (NAV) and purchase these funds.

There are 3 kinds of gilt funds.

One, gilt funds that invest mostly in g-secs across different maturities (2-year, 5-year, 10-year, 14-year, 30-year and 40-year).

Two, gilt funds with constant maturity of 10 years – these funds must invest at least 80% of their assets in government securities with a maturity of 10 years. Here, gilt fund managers buy a new 10-year maturity bond with every passing year and sell off the previous one to maintain constant maturity.

For example, in 2019 a gilt fund manager bought 10-year g-secs or bonds that mature in 2029. In 2020, the maturity period drops down to 9 years for the same bonds. So the manager will simply sell the g-secs and buy new g-secs that mature in 2030.

Third, gilt funds with rolling down maturity. Here, the g-secs are passively held and as a result maturity drops down every single year. Best example would be Bharat Bond ETFs.

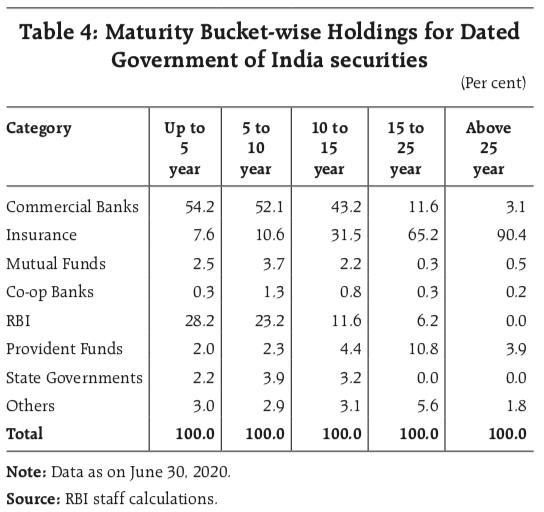

Let’s have a look at the ownership of mutual funds in g-secs across maturities

The above data is as on June 30, 2020 that shows 9.2% of overall investments in g-secs is happening through mutual funds or gilt funds. Reason for this low penetration can be attributed to limited awareness amongst retail investors. On May 18, 2020 – livemint wrote a small article about gilt funds titled Gilt funds give over 15% in a year, but retail investors should stay away. We don’t have any particular view on the article. It’s just how these funds are perceived to be.

Gilt funds don’t carry any risk of default.

This simply means, gilt funds invest in bonds issued by government of India. Like we touched upon in the last Thursday Trivia, that these bonds are issued to fund some long term projects. And it’s safe to assume that government will pay back. If government doesn’t pay back, then it’s not recession that we have to worry about, we will be in depression. Hence, it’s safe to assume that government will pay the money back and there will not be any default.

Unlike, a corporate debt fund where there is a risk of underlying companies not being able to pay up or massive amounts of sudden redemptions from the debt fund puts the pressure on fund manager – like it happened in Franklin Templeton case. In a gilt fund, there is plenty of liquidity available. This is not to say that gilt funds are completely risk-free, they do carry an element of risk.

Gilt funds carry interest rate risk.

Reserve Bank of India in its Monetary Policy Committee meeting decides whether to increase or lower the repo rates – the rates at which government lends money to banks. These repo rates have a direct impact on g-secs too.

So when the RBI starts reducing repo rates, the demand for government securities issued earlier goes up because they carry a higher interest rate. When the demand goes up, their price goes up and yields fall.

This is called the inverse relationship between the price and yield of bonds.

However, when RBI pauses on repo rates or starts hiking them, the opposite trend happens. Since the new bonds will carry a higher interest rate, demand for older bonds drops or traders sell them.

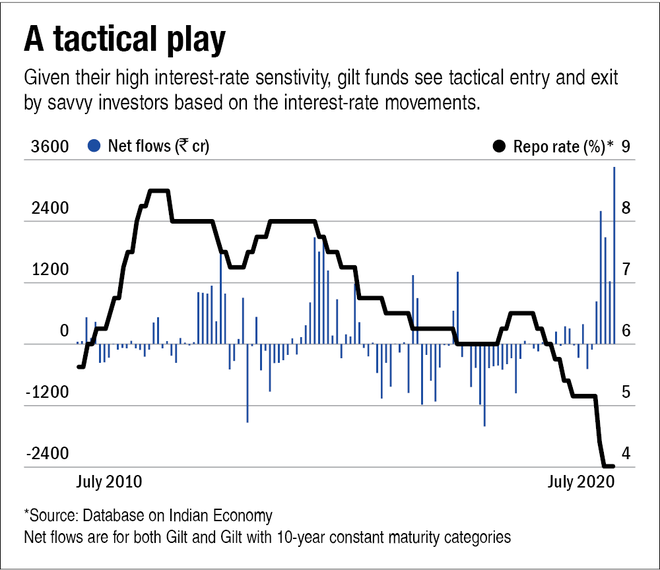

This is primarily the reason why most investors feel that it’s important to time the entry and exit of these funds. But is it so? Let’s have a look.

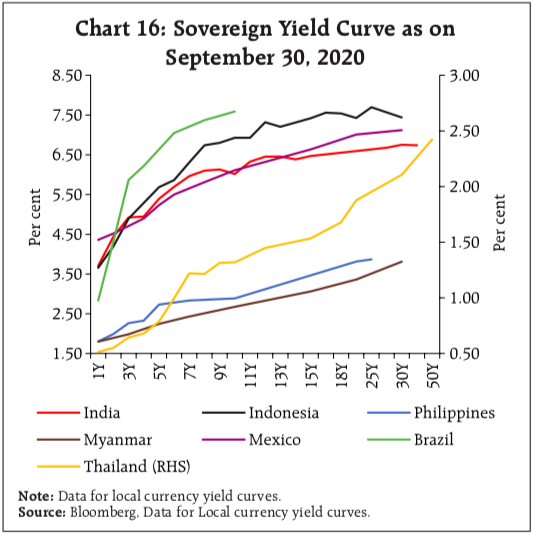

RBI in its recent article on GILT Market in India wrote about India having one of the flattest long term yield curve among the emerging market economies (displayed in the chart below).

Thailand has one of the steepest upward sloping curve along with Brazil. This indicates economic expansion coupled with high inflation. India on the other hand has managed it quite well. In the short term, the curve is sloping upwards but gets flatter as the time horizon increases. This gives a good sense of economic expansion while keeping inflation in check.

Volatility Factor

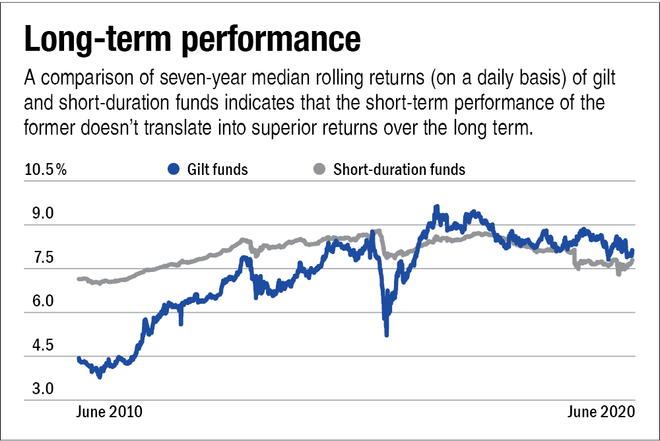

When we map the long term performance of gilt funds and short term duration funds. It’s almost similar. But look at that blue line, it’s like having an adventure of life. At certain point, when everything looks so bleak, it’s difficult to understand what will happen next.

GILT Funds

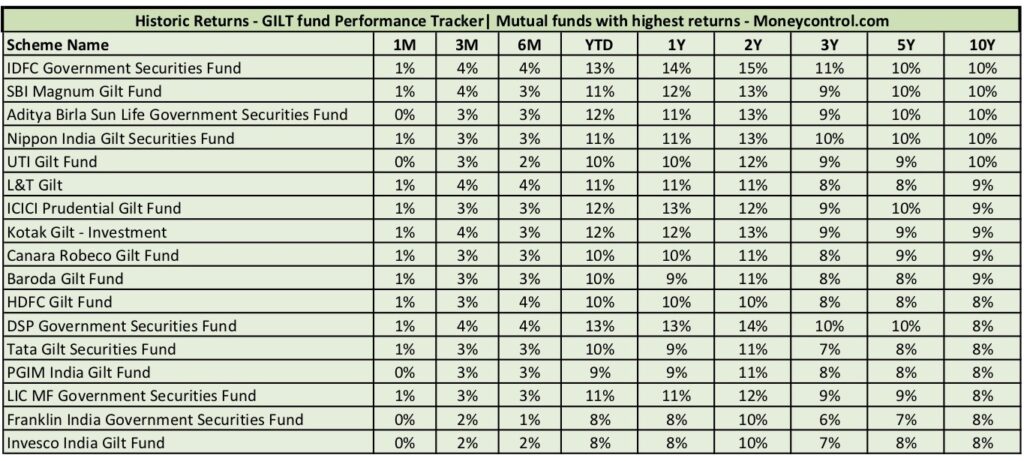

Historic returns of these gilt funds suggest that in the long term such as 5-year to 10-year term, returns moderate to 8% to 10% odd. Opportunities tend to arise when there are policy rate cuts from RBI.

That’s why we have investors going for the option of tactical play or timing the entry and exit. Due to the RBI consistently cutting rates, there have been a lot of inflows lately that has pushed returns in an upward direction.

Pitfall for Investors

Investors often invest in gilt funds after the policy rates have been cut in anticipation of a further rate cut. It’s too late till that because prices tend to shoot up quickly after the fall in rates. This means that an arbitrage opportunity for which savvy investors tend to look into this area has gone away. The action is already complete.

So consider this, if you invest now when gilt funds have delivered superior returns already, then there is limited to no chance for you to make the same returns for the next year. It’s only when there have been no returns since a long time in gilt space and you invest, that’s the time you as an investor have a real chance of making money.

Last but not the least: Taxation

There is no securities transaction tax (STT) that applies to the gilt funds. They are taxed as any other capital gain by investing in debt instruments under the Income Tax Act, 1961. If the investment duration is less than 3 years, your salary will be added to the short term capital gains and taxed according to your income slab. If for more than 3 years, the long term capital gains will be taxed at 20 percent with indexation.

Conclusion

Gilt funds is a decent investment option. However, due to its sheer volatility and lack of awareness in India’s retail investor base, these funds haven’t picked up. The sensitivity to interest rates and inability to predict the policy repo rate movements is also a strong cause.

Please note: This article doesn’t endorse gilt funds in anyway. Material produced here is for education purposes only.

written by Jinay Savla