Thursday Trivia ~ Easy Steps To Get Your Lost Aadhar Card Online

November 23, 2017Thursday Trivia ~ Are you Financially Free?

February 7, 2019

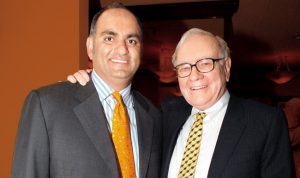

Last week we had the pleasure of listening to Mohnish Pabrai, the shameless cloner of Warren Buffet at the Morningstar Conference. He started his investment journey after 30 years of age with a little over $ 1 million in early 2000s and now is worth above $ 100 million.

Reading this, many investors would feel that he atleast had a $ 1 million to start with. However, this can also be viewed as he made an investment return of 100 times through his focus and dedication. Another view can be that since he was an active investor, he could make such a return. Agreed. However, being a passive investor – if we can grow our money better than a fixed deposit or a LIC, it would be a good proposition. I suppose.

Mohnish shared his 10 commandments which were more directed towards fund / asset managers, not all of them would be useful to our readers who are passive investors. Hence, we have identified 4 commandments which would be useful to our readers.

Commandment #1: Thou shall be singularly focused like Arjuna.

As investors, we control our process of investing. Returns generated by stock market is not in our hands. Yet, most of our focus is to time the market and see if get that 1% extra than our colleagues at work have generated. It feels nice to take a little risk sometimes.

But is it really worth it? Does it always play like that?

Losing out on our investment discipline and timing the market has often generated loss than profit. Nobody can predict the market; they simply have their own theories. Some work, most don’t. Therefore, while opting for a goal based investments, an investor should focus on his process of systematic investment plans (SIP) rather than acting on an immediate tip provided by someone just to make that extra buck.

Commandment #2: Though shall never short.

Mohnish made a very interesting point here. He said, the upside or maximum returns to be generated while shorting a stock (selling first, buying later – when it’s felt that price of the company will fall) is merely 100% or double. However, the downside or maximum loss is unlimited.

What? Why? How?

Suppose there is a Company A which has delivered poor results. Hence, the primary feeling in the stock market is that the price will fall. Company A has a price of Rs. 10 at the moment. Now if a trader decides to short this Company by putting Rs. 1,000. He simply sells the stock of Company A at Rs. 10. Now, when the price goes to Rs. 5, he would have made 50% returns and if the price touches 0, the trader would have made 100%. Logic of stock market states that price cannot go below 0. So the maximum returns generated by the trader would be Rs. 1,000 on his previous investment of Rs. 1,000. That’s 100% returns.

Now the TWIST!!!

Now if by any chance Mr. Market feels that Company A, may have delivered poor results right now but it will deliver superior results henceforth and decides to raise the price of its stock. Our trader friend here would be for a shock. At Rs. 15, trader would have made a loss of 50% and at Rs. 20, he would lose his entire capital. Now here comes the scary part. Logic says, price cannot go below 0 but it can go up above 20 right?

So right from Rs. 20, when the price increases – our trader friend would have to arrange money from some other source of income as his initial capital of Rs. 1,000 would have been wiped out anyways.

This is one of the reasons we always hear in our social conversations – do you know Mr. X played in the stock market and has now sold his 5 BHK and shifted to 1 BHK? Now is this the fault of stock market or trader?

Commandment #3: Though shall always have a rope to climb out of the deepest well.

This commandment may have a different meaning for different people. For us, it simply means – Asset Allocation. Never invest your entire corpus into high risk equity funds in lieu of future high returns. Diversifying our investments into different asset classes such as equity, debt, real estate and gold results into sound sleep even during stock market corrections. However, an investor tends to unfollow his / her discipline when markets have shown a stellar past performance.

Let’s take an example of recent run up in the market and resulting in a fall. Throughout 2016 and 2017, Sensex and Nifty only inched higher. Because of the recent returns, many investors took their money out of fixed deposits / debt mutual funds to invest into risky mutual funds. Some investors started buying shares of companies based on very little information couples with extremely high conviction – obviously because it was a tip.

Nifty after touching a high of 11,700 has now come down to 10,000 levels. A fall of 17% in a matter of days leaving many investors wondering for the next 2008 crisis. Rather than boasting about their investment returns, they are now asking – what do you think is the bottom? Let some time go, this bottom phishing will also not work. Why? Because they are not disciplined, they are in a state of panic and trying to time the market. And that never works!

Commandment #4: Thou shall never be Leveraged. Neither a lender a borrower be.

Many investors tend to take a loan against their own shares / mutual funds to invest more in the stock market. This behaviour is often triggered by high returns generated and overconfidence of the investor to make quick money in no time.

Or when an investor watches their neighbor doing very well and decides to offer him some money to be invested in the stock market at unreasonably high monthly returns. This often happens in the real estate business. Many real estate players promise a 40% yearly interest and after a year are nowhere to be found.

Both of these habits of leverage result in bad outcomes. It poses unnecessary risk to be undertaken to achieve those investment returns. In short, it’s just impossible.

Hence, at Cirlce Wealth Advisors we don’t encourage trading the stock market. Investments with long term horizon, average returns and low risk can make an investor super rich. Compound interest works wonders for those who believe in it and run the course.

– Jinay Savla