Thursday Trivia ~ The fairytale story of low interest rates and this time it’s different!

December 24, 2020Thursday Trivia~The power of incentives

October 21, 2022In cricket, India vs Australia is always an interesting set up. Especially, when it’s played in Australia. Indian team went 1 down into the second Border-Gasvaskar aka Boxing Day Test series at Melbourne Cricket Ground with no Kohli, no Rohit or Ishant Sharma. Team headed by Ajinkya Rahane while Shubhman Gill and Mohd. Siraj made their test debut. Pressure was high.

India won the test match with Rahane scoring a fabulous 112 in 223 balls in 1st innings and 27 not out form 40 balls in 2nd innings to safely sail through a victory. Earning a man of the match in the process.

What was so special?

Rahane played a long innings. No sixes in the match. Traditional cricket, limited shots and leaving or blocking most deliveries. Without taking any unnecessary risk, he brought the ship home.

In cricket and investing, there is one striking similarity. If you want to really want to have a long career and create wealth, it’s important to do very few right things but for long periods of time.

In line with doing very few things and going far, let’s look at 2 of India’s solid top order batsmen – Virender Sehwag and Rahul Dravid. If you had to pick 1, who would it be? Let’s look at some data.

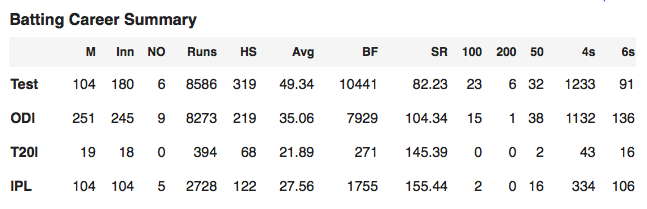

Virender Sehwag

source: cricubuzz.com

That’s a stellar record. Look at the boundaries, they speak for themselves. A solid strike rate too. We were assured fireworks when he took to the crease.

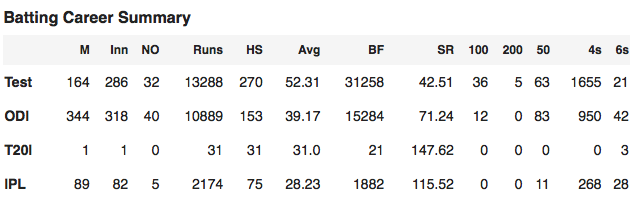

Rahul Dravid

source: cricubuzz.com

He too has a stellar record. With lower strike rate than Sehwag he has managed to hit 5 double centuries in test cricket. The wall always stood tall.

So who would you pick?

Sehwag got you the starts, he made the opposition look like they were bowling with tennis ball. Dravid on the other hand was defensive at the start. But he brought you home.

If you want a batsman who can play more matches, remain at the crease till you win and have a better average then you go for Rahul Dravid. He has remained not out for 72 times in Test and ODIs compared to just 15 times in case of Sehwag.As a result, he has a higher average and played more matches. Truly an asset to the team.

Please note: I’m a huge fan of both these players. It’s incredibly difficult for me to compare them. The point we are driving here is how the same idea will reflect on our wealth creation journey.

Personal Finance Implications

Albert Einstein once said that compounding is the 8th wonder of the world, the one who understands – earns it and the one who doesn’t – pays it. We all know this to be true. But we miss one important element – TIME.

Biggest criteria for making incredible wealth is not merely getting an investment idea that makes quick money, such as a stock tip, high interest paying real estate loans, etc. Consider, you get a stock tip that makes you 100% returns in 3 months. What next? You have to now work super hard for another stock tip. Will it give you the same returns? What if it does and what if it doesn’t? An investor then becomes a punter in the process.

Why not go for a moderate investment idea that gives you reasonable returns for a long period of time? How does it work?

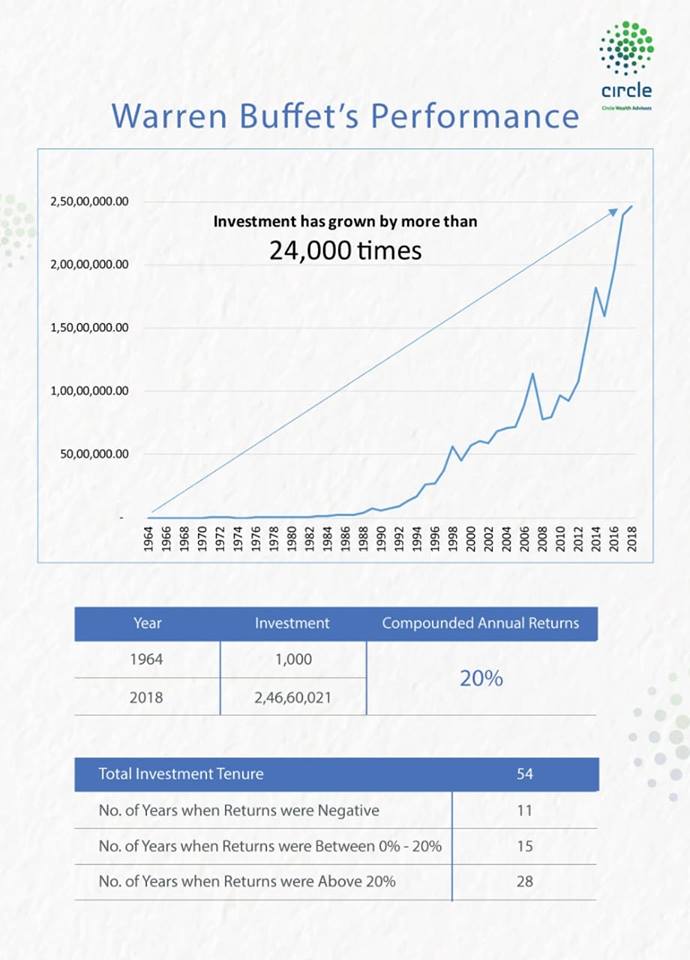

Have a look at Warren Buffet’s Net Worth chart

20% returns compounded over 54 years has made him the richest investor on the planet. Not to mention his investment has grown 24,000 times in the process. How?

Answer is simple – Power of Compounding.

Key Takeaway for 2021

Play the slow game like Dravid does. In the process, you remain longer in the game and your average naturally shoots up. Like you see Buffet, he stayed in the game for 54 years (56 now) at an average of 20% and made incredible wealth.

We have seen portfolios of many clients who in the hunt for next multi-bagger have either wiped out their years of savings or have an extremely low returns.

GO SLOW!

written by Jinay Savla