Name is Bond, Masala Bond!

July 28, 2016Dr. Raghuram Rajan : An Economist that India deserves!

August 11, 2016On August 3, 2016 Rajya Sabha passed the much awaited 122nd Constitutional Amendment to turn Goods and Services Tax (GST) Bill into law and replace different state and local taxes with unified value added tax system. In 2000, the Vajpayee government started discussion on GST by setting up and empowered committee under then West Bengal Finance Minister Asim Dasgupta. In a nutshell, it has taken 16 long years for the GST bill being approved by both the houses of parliament. But as they say better late than never.

Analysts say the implementation of the goods and services tax (GST) could provide the kind of productivity boost helping the economy massively in long term. Here are the various ways in which GST will help.

1) Unified market: The GST will cut down the large number of taxes imposed by the central government (e.g. central VAT or excise duty, services tax, central sales tax on inter-state sales, etc.) and states (VAT on sales, entertainment tax, luxury tax and octroi and entry taxes levied by municipalities). This will lead to the creation of a unified market, which would facilitate seamless movement of goods across states and reduce the transaction cost of businesses.

2) Lower incentive to evade tax: Currently, companies have to pay taxes on entire underlying value of the product/service, but under GST, companies in a chain will have to pay tax only on the value-addition. So, the actual tax paid will likely be small and reduce the incentive for evasion.

3) Widen tax base: GST will give credits for all taxes paid earlier in the goods/services chain incentivising tax-paying firms to source inputs from other registered dealers. This will bring in additional revenues to the government as the unorganised sector, which is not part of the value chain, would be drawn into the tax net. Besides, states will be allowed to tax services (as opposed to only the central government) under the GST.

Let’s us look at an example as to how GST will start benefitting the businesses and economy as a whole.

Indian truck drivers clock an average of 280 km per day, much below the world average of 400 km per day and far below the 700 km the average truck driver in the US does every day. The underperformance of Indian truckers has less to do with bad roads and less fancy trucks and more about prevailing archaic laws.

Truck drivers in India spend 60 per cent of their time off roads negotiating check posts and toll plazas, says UBS Securities, which has also found that there are 650-odd check posts in the country and 11 categories of taxes on the road transport sector.

Since road traffic accounts for 60 per cent of freight traffic in India, the slow movement of trucks across states leads to productivity loss. According to UBS, if the distance covered goes up by 20 per cent per day, Indian truck productivity would improve by 12 per cent.

Higher productivity would cut the need for buffer stocks; reduce the loss of perishable goods, cut down the need for many warehouses, etc.

According to the National Council of Applied Economic Research, government’s tax revenue will increase by about 0.2 per cent because of GST implementation, while GDP growth could go up by 0.9-1.7 per cent. Exports will also get a boost as they are zero-rated for taxes and also because the fall in cost of manufactured goods and services under GST will increase the competitiveness of Indian goods and services in the international market, UBS says.

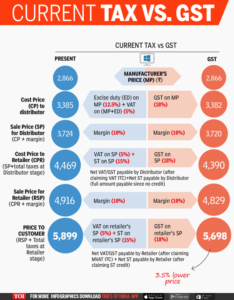

Now let’s understand this proposed impact of GST bill on supply chain and end consumer through an example. (GST assumed at 18%)

As we can see from the above, distributor will prefer to purchase with an invoice because it will give them a better profit margin. In the present scenario, the distributor will bear the burden of excise duty makes him more vulnerable to avoid taxes. This might make a few goods a little expensive but since tax evasion will be checked it will provide huge benefits to the country in years. Also, with more collection of taxes through an indirect route, it will provide much relief for direct taxes through income tax in years to come.

The party is not yet started

Yet, GST is far from reality as such. Rajya Sabha has approved 122nd Constitutional Amendment to turn the GST bill into law as there is no such law as GST Act till date. The bill will now be passed onto Lok Sabha, once an okay is received it will go for President who will ask the states to participate.

If 50% of states approve to the amendment, it will go to the President for the final ‘okay’. This will mean that constitution has been amended paving way for GST law.

Now the GST Bill will go through a parliamentary committee which will have to be introduced in the winter session. If there is an agreement, then the bill will be further discussed and put to vote in Lok Sabha and Rajya Sabha. After that it will be again sent to various states for approval, after that president will assent to it.

Hence, with a such a long process being on its way the Central Government is targeting to introduce it as early as April 1, 2017 or as late as April 1, 2018.

(Infographic courtesy Times of India and visual.ly).