Uniform KYC for all insurance policies

April 21, 2016Pros and Cons of keeping a Minor a Nominee!

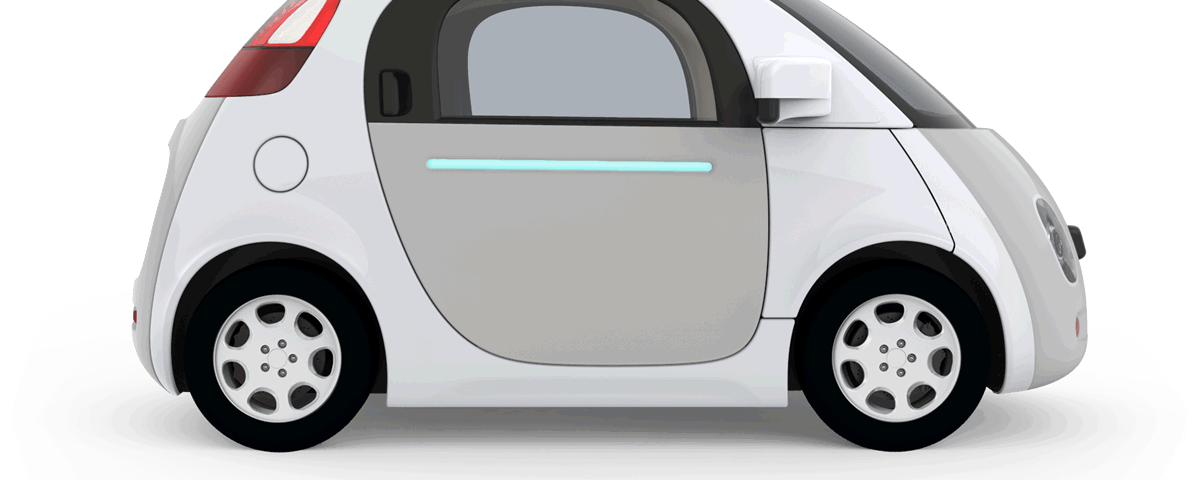

May 5, 2016There is a very high probability that next generation especially in metro cities would not understand their day to day life without cars. Right from being a luxury (when they were first invented) to becoming a necessity these days, cars have gone through a tremendous transformation in both its performance and availability. Technology has played a very key role in past few decades. The rate at which the technology in the automobile industry has changed, it has enabled a low cost production with better features resulting into an attractive purchase price for people.

Also, the availability of loans over the past couple of decades has improved significantly, in order to facilitate the purchase of a car. With the increase in number of banks offering better terms for loans, the power seems to now vest with consumers to negotiate better terms and conditions. This has led to a series of problems which now a consumer faces. With so many options available, it becomes difficult to first decide on which car to purchase.

But the major question still remains as to ‘how much money to spend while purchasing a new car?’

Usually, people demonstrate a very high level of emotions while purchasing their cars in India. For them it’s not a just a mode of transport sitting in the parking lot, it’s a family member. Also, there is a social proof in buying a car which demonstrates that a person is doing exceedingly well in their life. Sometimes, that social proof is so high that even buying one car is not enough. It’s a very sensitive topic to rationalise the financial decision making process in such cases. But as a measure of practicality, let’s try to rationalise the financial decision making process while buying a new car.

The most popular thumb rule for buying a car is 20 / 4 / 10, which implies that a consumer should make a minimum 20% downpayment and the loan tenure should not be more than 4 years with expenditure (includes EMI, fuel cost and insurance) on a monthly basis should not cross more than 10% of the gross monthly income.

Another way to interpret this rule is that the cost of the car should not be more than 40% of the annual gross income of the consumer.

Let’s take an example of an individual whose gross annual income is Rs. 20 Lakhs which results in a gross monthly income of Rs. 1.66 Lakhs

Cost of car – Rs. 8 Lakhs (40% of 20 Lakhs)

Downpayment – Rs. 1,60,000/-

EMI – Rs. 16,232/- (interest @ 10%)

Tenure of Loan – 4 years

Hence, even without incurring any fuel cost, expenditure on EMI comes to 10% of gross monthly income.

Therefore it is advisable that the consumer should restrict the range of buying a car from 25% to at maximum 50% of gross annual income depending on how frugal to flamboyant a consumer is.

Also it is important for the individual to determine his / her priority in terms of saving for retirement and other important financial goals. In other words, consumer should spend on a car only after he / she has created an emergency fund and is saving enough to meet retirement and other important financial goals eg. children’s education.

Don’t go by the price tag and one-time tax levied on a car. These additional costs should also be added into calculations.

Interest on loan: Don’t forget to include the interest if you take a car loan. In the above example, total interest on loan comes to Rs. 1,40,00/-

Maintenance and repairs: After the first few free services, every visit to the service centre will cost you Rs 2,500-25,000, depending on whether you have an A-Star or a BMW.

Depreciation: This is the drop in the car’s value. The minute you drive out of the showroom, the value dips by 20%. No matter how well the car is kept, the value will dip by 15% every year, reducing the value of a Rs 5 lakh car to Rs 2 lakh in five years.

Image Courtesy : www.google.com