Does the Economy-Stock Market Relationship Impact Your Investments?

October 1, 2020A trait that your Personal Finance Advisor must have!

October 15, 2020There’s a great Warren Buffett quote, or Charlie Munger quote, that says, “I can’t tell how many times I’ve heard Warren say, ‘It’s not greed and fear necessarily that drives the investment world. It’s envy.’”

Such words of wisdom are rarely understood by average folks like me. I must have read about how envy tends to destroy investment returns, but couldn’t understand it. To be honest, in personal finance, we are simply stuck with the idea of greed and fear. Hence, our vision becomes narrow and at times highly susceptible to errors.

There is always a silver light amidst dark clouds. The concept of Envy has been wonderfully explained by Gurcharan Das in his book The Difficulty of Being Good. For those like me who love reading books during their free time, this book is a must. The book revolves around author’s take on Mahabharata which is a direct result of a learning sabbatical taken to learn Sanskrit and our ancient scriptures.

It’s not just about how complex concepts can be explained simply, but the book gives us a peak into the mind of its author who has the ability to accept his flaws and speak about them even when he is at the peak of his career. Readers like me need more authors like Gurcharan Das.

We have all read how envy consumed Duryodhana. Here’s a glimpse of it in author’s own words.

Soon there is rivalry over the succession. Prince Duryodhana, the eldest son of Dhritarashtra, disputes the right of the eldest Pandava, Yudhishthira, to take over the throne. Angry and vengeful, Duryodhana threatens, abuses, and attempts to assassinate the Pandavas, who are forced to flee the kingdom. During their exile the five brothers jointly marry Princess Draupadi and meet their cousin Krishna, who is God, and who becomes their friend and companion for life.

In the hope of stopping the conflict between the cousins, Dhritarashtra divides the kingdom, giving the barren half to the Pandavas. Despite their disadvantages, the accomplished Pandavas work hard, clear a forest to live in, and prosper. They rule justly and expand their territories through conquests and alliances, and they build a striking, grand capital called Indraprastha, which some archaeologists believe is buried under present-day Delhi. Soon they are widely acknowledged to have become the paramount power, and the Kauravas grow jealous again.

‘Scorched by envy’ of his cousin Yudhishthira, Duryodhana is sunk in gloomy thought.3 Seeing him thus, Shakuni asks, ‘What is the reason that you travel with so many sighs?’4 Duryodhana replies: I saw the earth entire under Yudhishthira’s sway, conquered by the majesty of the weapons of the great spirited Arjuna. I saw their grand sacrifice, Uncle . . . Rancour has filled me, and burning day and night I am drying up like a shrunken pond in the hot season.

The memory of ‘those manifold riches which the kings heaped’ upon Yudhishthira as they ‘waited upon him like tax-paying commoners’ makes him prey to envy.

He says: For what man of mettle in this world will have patience when he sees his rivals prosper and himself decline? . . . When I see their fortune and that splendid hall and the mockery of the guards, I burn as if with fire.

Shakuni consoles him, saying that it is useless to brood over the good fortune of his cousins. They cannot be defeated in battle; they are far superior warriors, and have made important alliances which give them immense power. One needs clever means. Shakuni suggests a gambling match.

And thus begins a journey of complete destruction, where in the end Duryodhana will lose everything, including his own life along with his family. But he can’t see it at that moment, because envy has consumed him.

(Our favorite Duryodhana for the Mahabharata series of 90s)

The reason I get compelled to draw parallels from books is that some authors give you a way to look within yourself and see if you have a bit of Duryodhana residing rent-free in your head. That’s why I prefer spending time with such great minds and reading their work to watching an episode of Big Boss.

Personal Finance Implications:

Swag of owning a Real estate and the hunt for certainty in an uncertain world

Buying a home is a dream we all share. After all the hard work one puts through studies and work, a home is what we come back for. Hence, buying a home for fulfilling our dreams and consuming it fully makes complete sense. The part where we tend to buy multiple homes and are not able to consume it, a bit of trouble starts from there.

The tendency to buy multiple homes has a huge impact on our retirement portfolio. As per the RBI’s Household Consumption Report of 2017, more than 95% of India’s wealth is locked in illiquid assets such as real estate and gold.

The question arises as to why is there a need to buy so many homes when we cannot liquidate it in the time of its need?

The intangible value attached to real estate is often related to status. Society looks up to those who owns multiple homes. Our natural inclination is to rise in this pecking order of society and hence we get consumed by such envious thoughts.

Certainty Factor

As a wealth manager, we have to live with an extremely difficult conversation of ‘kitna returns milega.’ Sometimes I pray to our God in the Investment Buisness Mr. Warren Buffet to give an answer. And like many other Gods, he just smiles and say, I don’t know which in other words mean leave it to your fate, dear.

The dilemma continues because reciting our God’s answer opens up to all kinds of conversations. The first one being a particular builder channel financier used to give me 18%, so anything below that is sort of unacceptable. Those who have burned their hands with such builder channel financiers, tend to ask for a modest 12% citing a 6% return decrease on their lifestyle expenses. Quite modest, I must say.

But the hunt for certainty comes at a cost. People tend to miss the big picture which is safety of capital invested. Most of such channel financiers who used to give abnormally high returns are either out of business or switched to another industry. It’s strange but true.

High spending just to please others

Spending isn’t wrong. If you want to buy your dream car and have the funds, then by all means you must own that car. Same goes for a fantastic international holiday that helps you relax and gives you a break from daily routine. And etc etc…

The issue is when we spend just to please others.

It’s also been our experience that many folks tend to spend a lot more than they need either to just stay in a certain social circle or just because someone else is doing it. Buying a bigger car because a certain neighbor has it or going for an international vacation because everyone is doing it.

It’s another form of envy. This tends to reduce their savings rate and happiness index of life. The result is unhappy present and uncertain future. That’s why we tend to emphasize a lot of financial goals.

Education and Career with an ultimate hunt for a secure future

So many of us have witnessed such an expression of life first hand. I remember signing up for competitive exams in finance and my best friend’s mother forced my buddy to sign up for the same exams even when he didn’t want to. The result is that he is struggling with those exams and have switched to a different profession altogether. Lost a few years, gained a first-hand experience at envy.

Sometimes I feel, competitive exams also have some form of swag. Just because everyone is doing it, then it’s the right way. Or we should do it just because a close relative or a friend is doing it. In such a process, we tend to miss out on our strengths. A life of mediocrity awaits.

Stock Markets and the inability to invest as per asset allocation

There’s one more thing we have seen witnessed that due to envy, people tend to see different patterns in stock markets that usually don’t matter much. Some call it charts; experts call it technical analysis.

There are some folks who try to follow the money. They feel something will move where the big fishes are. Other than blindly copying some star fund managers or super star investors, they look at some irrelevant data (from an investor’s perspective) to make sense of their investment thesis.

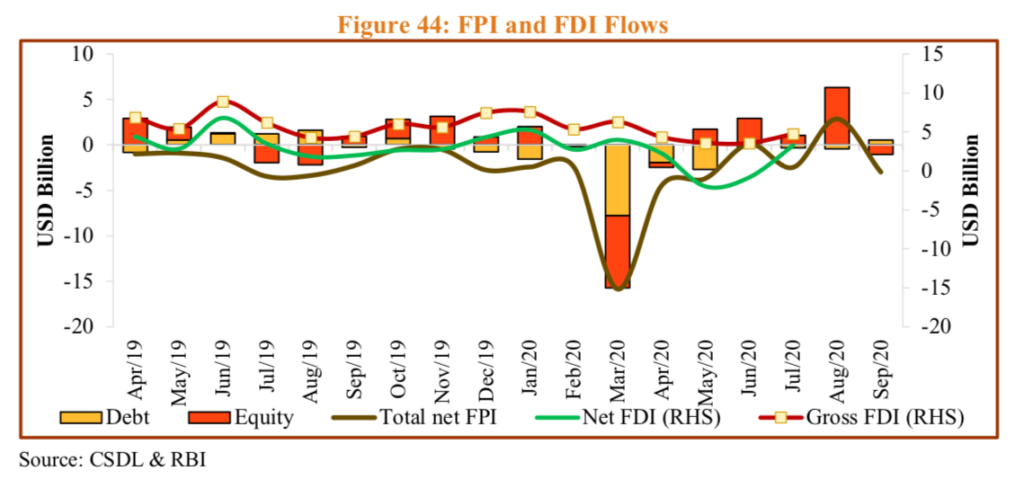

To explain my point, let’s look at inflow / outflows of Foreign Portfolio Investors and Foreign Direct Investors.

To a retail investor who wishes to create wealth in stock markets, should this graph matter to them? No, right. He makes money when his investment works out and not linked to what other institutional investors are doing.

Yet, due to the constant hammering on different media channels such charts are usually shown to draw a rosy picture. It becomes an incentive to lure retail investors to create some meaning out of this story where there is nothing.

Our inability to sit on desired asset allocation strikes from the fact that we can’t sit outside the stock market while others are making money. This form of envy has consumed some of the greatest minds in stock markets.

Initial Public Offering (IPO) frenzy and the hunt for a quick buck

Off lately, there has been a rush to hit the IPOs of companies with the Fear of Missing Out (FOMO) which is primarily driven by Envy that someone makes money while you are doing nothing. News of oversubscription of such IPOs is the primary bait into hitting the right cord of investors.

Think about this – you invest Rs. 1 lakh which might not even be a meaningful amount in your portfolio. You get allocated around Rs. 15 thousand to Rs. 30 thousand. Then the price doubles. So you make close to Rs. 30 thousand to 60 thousand. You feel the jackpot. Share this story with everyone.

But suppose you have around Rs. 25 lakhs sitting in a fixed deposit which is not even beating your own lifestyle inflation. But you are too worried about investing the long term as most folks around you have lost money gambling. But you don’t want to lose money in a sure shot IPO.

Does this make any sense?

This drive for immediate gratification and wanting to beat or match your peers while making money makes you do some strange things, isn’t it.

There are folks who are unhappy as they didn’t get any allocation in IPOs. They have loans pending for which they have taken the moratorium benefit. Money that should go towards EMIs or spending some quality time with family is spent gambling just because others are getting rich fast too.

Conclusion

There are multiple ways to deal with envy. One way is to be aware of this emotion in us and not react to it. Second way is to appoint an expert on the subject and let him make some key decisions for you.

If you want to decide on a career for your child, then it’s better to have a career counsellor and have a detailed evaluation. Same goes for health. In finances, it’s always better to have a registered investment advisor who works for you and advises you on what decisions to make.

To conclude here’s a bit of impact of Envy in the life of Gurcharan Das as he so candidly shares in the book.

The sort of envy evinced by Duryodhana was not unfamiliar to me when I was growing up in Simla. My mother had a great and unfulfilled desire to be a part of Simla’s fashionable society. She envied those who belonged to ‘the club’, the glamorous Amateur Dramatic Club. She must have transmitted this to me, for I grew up with an acute concern over my position in society, comparing myself to those who had things that I did not possess, boys who were more attractive to girls than I was, and especially those who made it to the school cricket team.

John Rawls, my teacher at Harvard, would have characterized my mother’s sentiment as ‘general envy’ of Simla’s high society. General envy, he explains, does not have a particular person as its object, and is experienced by the less advantaged for those better situated. Duryodhana’s ‘special envy’, on the other hand, is specific to the Pandavas. It covets the specific things that the other person possesses. Occasionally, general envy can become specific as my mother’s did when it became concentrated on our neighbour.

Duryodhana couldn’t stand his brother Yudhishthira doing a better job, hence an entire Mahabharata had to happen due to his envy. He couldn’t stand the luxury, money, praises, lordship, etc. which he too had just that his brother had a little bit more.

On the same lines, I too couldn’t focus on my job and joined the Envy brigade at my first job only to make my life miserable. The result was that I lost out on opportunities and great friendships. Something I am focusing very hard on creating now.

For the author Gurcharan Das, he has seen envy closely and written about it in the book. May it be personal or professional life. The fact that he is so candid around it has made me write this long article.

A tribute to great writer whose every word leads us to introspect our own life.

Let’s lose this envy and focus on our strengths, I’m sure a lot of good can come from just staying away from poisonous thoughts.

Also read: One book recently that gave me a different perspective has been The Victory Project by Saurabh Mukherjea and Anupam Gupta. You can read my book summary and the concept of T that can be used to live an invincible life.

Photo credits: google images, economic times