Mobile Budgeting Apps

August 31, 2017Save Tax upto Rs. 3 lakhs – New Provision on Taxation of Gratuity

September 13, 2017‘How does change happen?’ asked a curious student. Teacher smiled and replied, ‘Two ways. Slowly at first then Suddenly!’

In last week’s Thursday Trivia, we presented a wave of change in recording household and personal budgets. An activity, which we have been used to traditional single entry book keeping method. Over the years, double entry book keeping system has gone through remarkable technological innovation. There are very good softwares for such a system of book keeping. Because of it’s extensive commercial use, it was disrupted before our traditional single entry book keeping budgeting method for households.

Post demonetisation, a wave of being cashless has erupted in India. Going cashless has it’s own economic benefits. But we all know, how difficult it then becomes to keep a record of our expenses. This was the major concern of most people post demonetisation.

Last week, few of our readers asked us to recommend a good mobile budgeting app. Since, we do not engage in recommending one particular app, we decided to ourselves use a few apps and write about it’s advantages as well as disadvantages. However, let’s not look at each one individually but let’s look at what we require our mobile app to do and work it forward from there.

Linking multiple Bank Accounts

A question that was raised by one of our reader was does these apps link our bank accounts? Is it safe? Won’t cyber security hack into it? Isn’t the whole system subject to a great danger?

Bank account numbers are not linked through online banking. Suppose, you swipe a card for a dinner at your favourite restaurant. A message will come on your phone, which mentions the amount debited, account number, date, time and in brackets even your current balance in the account is mentioned. Apps such as ET Money, Walnut, Money View request your permission and collect the information for the same.

However, it was disappointing to see apps such as Qykly, vMoneyTracker and Coin Keeper which are highly rates did not perform this basic function and requires the user to input these details manually. This not only creates a disinterest to use the app but defeats the whole purpose of providing ease to the user.

Statement of Expenses

In Apps such as ET Money, Walnut and Money View the bank accounts are linked, so every time the user swipes his card, these apps appear on your screen and ask you to allocate various heads under which that expense should be put. It’s an easy 5 second job for the user.

However, cash expenses has to be put in manually under different heads. At first it might take some time, but after a while it just becomes a matter of seconds to record the same. Cultivating that habit would be very important. In simply 3 clicks, a cash transaction can be recorded. If this is not ease, then what else is?

In apps that do not link your bank account, an entry has to be manually fed into. This just gets boring after a while and chances of expenses getting unrecorded are high.

User interface to view expenses is much better in Walnut and Money View than most other Apps. Since, every app gives a gamified view of expenses, Money View is found to be very clean while Walnut is just one step behind it. Rest others have a lot of information on those pages which might not be of relevance such as ‘Share’ function in ET Money on platforms such as Facebook, WhatsApp and Twitter. It doesn’t make sense as to why a person would disclose their monthly expenses on social media platforms. WhatsApp still kind of makes sense as to share it the statement as a report format, but then a simple screenshot is available on the phone to do it.

Hence, the common sense behind building such an interface is also compromised.

Set Budget and Reminder of Bills due

This is a plain vanilla function which is available in every App. All you have to do is just set your budget amount. However, budget cycle remains the same ie. starting from first of the month to ending on last date of the month. A reminder of bills along with their due dates is no more a requirement. Utility companies such as, electricity, telephone send their customers reminder messages well in advance. This setting is useful when there is a payment gateway through the app which automatically makes the payment. However, as of now the function is not available while your mobile wallets perform this function.

Again going back to the first point, if your bank accounts are linked then this function will make sense to you. Otherwise, manually feeding every expense will not serve the purpose.

Option to Invest

Only ET Money App allows to make investments while the rest of the apps don’t have this function. At the first mention, this seems like a tempting function. However, ‘investments are subject to market risks!’ speaks our mind. While budgeting for monthly expense, having an option to make investments sounds like a good deal. But having too many things in one app takes the flavour away.

The App allows making temporary investment in liquid funds, gold funds to selecting a mutual fund and starting a systematic investment plan with the same. The question is would you trust your money being invested by an App or by a human being who assures to take care of your hard earned wealth? It depends from person to person, however exploring the app would not be a bad idea.

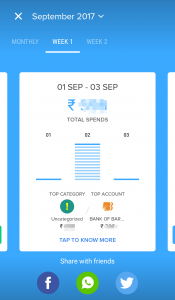

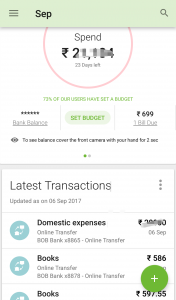

User Interface on Spending Summary

ET NOW MONEY VIEW

Summary

To summarise, Walnut and Mone y View stands out distinctly with a cleaner user interface that makes it easy to record a transaction. However, Walnut is not available for iOS users till now. In the start, it may prove to be a trouble to watch our expenses being recorded on a mobile phone but in time it sort of becomes a habit.

User interface and experience in these apps will improve over time as this vertical has not been explored for personal finance as yet. Once enough people start using it, these Apss will look a lot different from what they are now.

– Jinay Savla

Disclaimer :

Currently, we have limited our review to only ‘free’ versions of these Apps. There maybe a case where “Premium’ version which provides a different experience. Incase, you have in past or are currently using a budgeting App, then please do share your experience in the comment section below.

Also, if you have a specific query on any function of the App which we have not covered here, then please feel free to write it below. We will be more than happy to help.