Super simple explanation of Fed rate

December 17, 2015

Pros and cons of holding a joint account

January 14, 2016

An existing or prospective mutual fund investor may not remember the name of the scheme he has invested into. But surely would remember the disclaimer declared in every communication “Mutual fund investments are Subject to Market Risk”.

So this leads us to a question, what exactly is market risk? Market risk impacts you in all areas of life right from your job to something as regular as buying groceries.

Wikipedia defines Market risk as

“Market risk is the risk of losses in positions arising from movements in market prices.”

Market risk, also referred to as systematic risk, involves factors that affect the overall economy or securities markets. It is the risk that when an overall market will decline, it will bring down the value of an individual investment in a company regardless of that company’s growth, revenues, earnings, management, and capital structure.

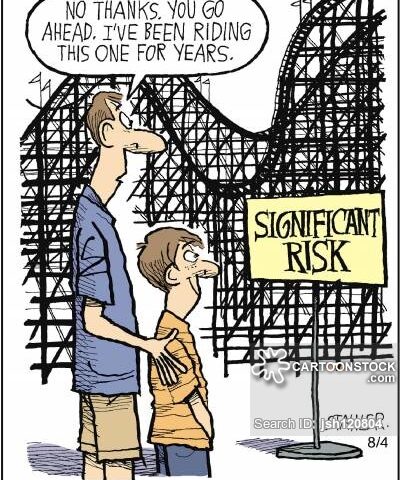

So let’s understand it with this simple example and see how exposed we are to it’s impact.

When you decide to buy a car, it is usually to fulfill a need of reaching your destination within a stipulated time period. Just the same way, as you make an investment, it is associated with a future goal which needs to be serviced as and when it comes up.

As you start to look out for a new car, there will be lot of factors to consider like price, engine capacity, mileage sitting capacity etc. Apart from these you will also consider the safety features like air bags, ABS etc. According to your specific requirement and your own travel pattern you will choose a car which is best suited for your needs. Similarly, while approaching an investment decision, factors like return on investments, safety of capital, interest rates, liquidity, etc. will also be looked upon for reaching the desired goal of the investor.

But whichever car you choose you will be subjected to certain risk of road travel (read Market Risk), which is independent of the car itself. These risks like bad road conditions, unfavorable weather, heavy traffic, etc. will impact your travel and your plans to reach your destinations. If these events occur you may have to tackle it by taking a detour, waiting for some time or may be choose even a different mode of transport.

This is exactly what happens when an event pertaining to market risk occurs and as an investor you are subjected to risks like inflation, fluctuation in interest rates, fluctuations in foreign exchange, geo political risks, war etc. These are big forces and will impact the overall market; it has nothing to with the specific investment vehicle that you choose, like mutual fund or equity investments all other investments are actually subject to market risk, be it the investments which are perceived to be safest like real estate or gold, will react to change in macro conditions.

If you look at things more closely and from another perspective, we are subject to market risk all the time. If you are an employee you may choose a great employer to work with, but again change in market condition may result in change of your job profile and appraisals. It might be nothing specific related to you or your company, it is just what happens in market impacts everyone including you.

Conclusion:

Looking only from an investment point of view, we can easily infer that all the investments are subject to certain kind of risk. As you understand more about these risks it will help you in taking more informed decisions. As far as market risk is concerned it is unavoidable and one of the most useful way of tackling it by having a right asset allocation strategy and rebalancing it periodically.